As we as a whole know exceptionally well that the accepting cash from the west has dependably been an issue for the experts in its field and it a major obstacle in their way. In Pakistan numerous known installment ways are not accessible like Paypal and some more, in this circumstance they need to experience a few tiring and tedious systems for exchange their cash here in Pakistan.

What is Payoneer?

Payoneer is an installment arrangement organization that issues Prepaid MasterCard Debit Cards to consultants and other individuals getting salary from remote nations. Payoneer cards can be utilized as a part of Pakistan. How it functions is that you get cash through various Payoneer accomplices (counting Freelancer.com, oDesk.com, Elance.com and so on).

The good news is now you can get your Paynoneer in Pakistan. Presently Payoneer enables withdrawal of assets to Pakistani Bank accounts, Payoneer is the worldwide installment system, which deals with all our online exchanges, regardless of on the off chance that, it is a smidgen of dollars to an extensive salary, it gives you a chance to execute securely all through the world.

Payoneer has opened its wire exchange administrations for the Pakistani banks Payoneer permits withdrawal, with which, with a payoneer account anybody will have the capacity to move supports in Pakistan from their Payoneer record to a neighborhood ledger. This is vitally going to help Pakistani consultants who confront numerous troubles in charging their remote customers, anybody with having Payoneer record can get installments from anybody on the planet.

Payoneer offers a mind blowing installment answer for the individuals who get cash from Payoneer partners. Payoneer in Pakistan is an especially valuable alternative since the world’s most prevalent installment choice Paypal isn’t by and large accessible in Pakistan.

In any case, for the individuals who are utilizing Payoneer out of the blue, it can be genuinely confounding at first. This article will examine all that you have to know with respect to how to utilize Payoneer in Pakistan. In the prior specialists used to pull back their assets through Payoneer ATMs, and this was extremely costly way, now Payoneer clients can basically include their Pakistani Bank accounts and effortlessly ask for a withdrawal.

As of now you can just pull back US 200 dollars, this farthest point is set for at first, it is striking that Payoneer presently doesn’t bolster Pakistani Rupess as a cash, it implies that your nearby bank in Pakistan will charge 3.5% expense for the money trade of these assets also. It is likewise prominent that assets exchange from Payoneer account in to a financial balance will be a typical wire exchange and it might take 2 to 5 business days.

Various Pakistani individuals outsourcing and completing a few different business at worldwide level and they are confronting obstacle in their installment withdrawal process and Pakistan without a doubt needs more portals for installment process and the IT segment needs a gander at this issue as quickly as time permits.

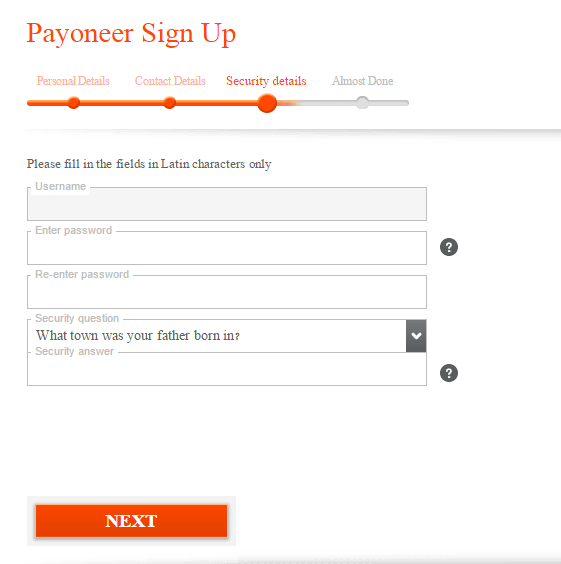

What is the Process to Sign Up for Payoneer?

You can either agree to accept Payoneer by clicking here (yearly charge rather than month to month charge + $25 reward once you stack $100 to your card) Or then again you can join straightforwardly through your Payoneer accomplice and pay a month to month expense and get no reward.

Advantages of Using Payoneer

Since Paypal isn’t accessible in Pakistan, Payoneer remains the most dependable approach to get cash from customers abroad. Despite the fact that on occasion you may feel like the charges are high, you are ensured on-time cash.

You can pull back cash from select ATMs crosswise over Pakistan, or utilize the cash at POS terminals at petroleum pumps, shops, eateries and different merchants. In the event that you choose to go for Payoneer, you don’t need to depend on nearby banks, which have a propensity for charging concealed expenses.

How Long is the Shipping Process?

Payoneer card can be shipped to Pakistan is under 25 calendar days. This implies in the event that you select consistent transportation choice, you can get your card inside the calendar month. An expansive number of individuals got their cards inside 20 days, however for some extraordinary cases, it took upwards of 40 days.

On the off chance that you require your card desperately, you can pay additional and have it couriered to you inside three working days. In any case, so as to do this, you need to pay a heavy charge.

Get to Know the Fee of Payoneer

The following is the expense table for the card in the event that you choose to arrange from this site. On the off chance that you choose to arrange it through a particular accomplice, look at the charges for that particular card while applying for it. Most cards have a similar expense structure, aside from rather than a yearly charge of $29.95, they have a month to month charge of $3 (totalling to $36 every year).

Know About the Transaction Limit of Payoneer in Pakistan

The per-exchange restrict relies upon the machine. Most MCB machines, all Samba and all SCB machines enable clients to pull back Rs. 20,000 for every exchange. There is no restriction on the quantity of exchanges yet unique Payoneer cards have withdrawal constrains so you should look at that when requesting your card.

Steps to Use the Payoneer Card

Activating the Payoneer in Pakistan

- Tear open the envelope you have gotten from Payoneer via the post office.

- Unpack the card and take out the activation guide.

- Go to your PC.

- Go to www.payoneer.com.

- Click on Activate your card in the board on the privilege.

- Enter your record points of interest to login to your Payoneer online record. The username is your email address and the secret key is the thing that you picked it to be.

- Once you login, you will see a catch you can snap to actuate your card. Snap it!

- Enter the 16 digit card number situated on your card, and pick a 4 digit stick number.

- Your card has now been activated.

Using the Payoneer in Pakistan

- Your Payoneer card can be utilized as a part of thousands of areas crosswise over Pakistan

- Remember that all exchanges in Pakistani ATM machines are done in Pakistani Rupees.

- Mae sure not to check ATM balance from ATM yet to check it on the web. Most machines in Pakistan don’t bolster checking of adjust of MasterCard cards, and your card could stall out in the event that you attempt.

- You can likewise utilize your Payoneer MasterCard plastic at any shop, petroleum pump or eatery that acknowledges MasterCard installments. Every huge store and so forth acknowledge this strategy for installment.

- You must enter in the amount in ruppees subsequent to changing over the dollar sum that is in your card. You can just pull back in rupees and not in dollars in Pakistan.